Healthcare

Union Workers

Union Workers

Extended healthcare for individuals covered by the Industry Wide Agreement (IWA) or Division A contract:

1 Q: I have been laid off due to the coronavirus. How long will I have healthcare for?

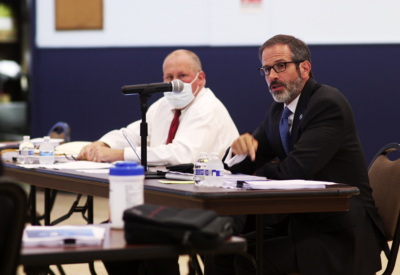

A: At the onset of the pandemic, now-HTC President Rich Maroko filed for arbitration to win extended medical coverage for laid-off workers. Through a series of arbitrations and tough negotiations, most workers in IWA and Division A hotels who were laid off due to the coronavirus had healthcare coverage from April through the end of 2020.

Under the American Rescue Plan the federal government will pay 100% of the cost of COBRA for many laid off workers from April 1 until September 30. This means that many of you (and your families) can return to our Union’s health centers soon. It also means that we will be able to reopen the Brooklyn and Harlem health centers, which had to temporarily close in January.

2 Q: How do I enroll in subsidized COBRA under the American Rescue Plan?

A: Many members have already reached out, asking how to enroll in COBRA. Our Benefit Funds are waiting to hear more details from the federal government. Once we have instructions for how to sign up, we will publish the details on our website and send out a text and email alert. Make sure that you are signed up for union alerts here.

3 Q: What are my options if I no longer have healthcare coverage and I am not eligible for COBRA?

A: The Union has compiled a guide about the many alternative healthcare options that will be available to you should you lose healthcare coverage in the upcoming months. We encourage you to review this guide to explore which plan will be best for you and your family. Click here to be redirected to that guide. If you have any questions, or need assistance, you can contact us at (212) 245-8100 and select option #1.

4 Q: What are the hours of the health centers during this crisis?

A: In an effort to protect members and health center staff, the hours of each health center and health center pharmacy were reduced starting in March 2020 and will continue until further notice.

Please note, in January 2021, the Brooklyn and Harlem health centers were temporarily closed due to the reduction in patients and contributions. The Brooklyn and Harlem Health Centers are currently being used as COVID-19 vaccination sites and we are hopeful that they will be able to fully reopen thanks to the COBRA subsidy provided in the American Rescue Plan. We will update our website with any changes.

Midtown Health Center & Pharmacy

773-775 9th Ave., New York, NY 10019

(212) 586-1550

- Hours of Operation: Monday through Friday, 9:00 AM-5:00 PM

- Pharmacy is OPEN Saturday – 9:00 AM-5:00 PM

- Pharmacy is CLOSED Sunday

Queens Health Center & Pharmacy

37-11 Queens Blvd., Long Island City, NY 11101

(718) 361-1500

- Hours of Operation: Monday through Friday, 9:00 to 5:00 PM

- Pharmacy is OPEN Saturday – 9:00am-5:00pm

- Pharmacy is CLOSED Sunday

5 Q: How do I contact the central office of the Benefit Funds to ask about my coverage?A: If you have questions about eligibility, COBRA, claims, or other questions related to your coverage, you can contact the Benefit Funds central office at (212) 586-6400. The Benefit Funds has set up a new voicemail system and is experiencing a very high call volume, so it may take several days to get back to you at this time. We ask that you please be patient.

You can find the appropriate routing number for your call to the Benefit Funds below.

Department |

Phone Number |

Employee Benefit Funds’ Main Phone |

|

For workers who worked during the extension period and may be eligible for additional coverage |

Press 1 |

For eligibility questions |

Press 2 |

For COBRA questions |

Press 3 |

For claims |

Press 4 |

For Members’ Services |

Press 5 |

For legal questions |

Press 6 |

For pension and 401(k) questions |

Press 7 |

For scholarship and training questions |

Press 8 |

For Members Health Assistance Program ("MHAP") |

Press 9 |

Extended healthcare for individuals covered by the Greater Regional Industry Wide Agreement (GRIWA):

1 Q: I have been laid off due to the coronavirus. How long will I have healthcare for?

A: On March 19, 2020, the arbitrator ruled that shops signed on to the GRIWA must pay for 6 months of healthcare coverage for HTC-represented workers who have been laid off due to the coronavirus. On September 23, 2020, the arbitrator ruled on a dispute between the Union and the hotel industry. He affirmed the Union’s position that this 6 month obligation begins as of the date the laid off worker lost coverage. For thousands of workers enrolled in UNITE HERE HEALTH Plans 100 and 105, this occurred at the end of July. As a result, those workers will now have coverage through March 31, 2021.

Many workers will be eligible for subsidized COBRA from April 1, 2021 through September 30, 2021 thanks to the American Rescue Plan. We are waiting for the federal government to release more guidance about eligibility and how to enroll. We will update our website and send a text alert when we have more information. Make sure that you are signed up for union alerts here.

2 Q: How do I enroll in subsidized COBRA under the American Rescue Plan?

A: We are waiting for the federal government to release more guidance about eligibility and how to enroll in subsidized COBRA. We will update our website and send a text alert when we have more information. Make sure that you are signed up for union text alerts here.

3 Q: What happens if I no longer have healthcare coverage and I am not eligible for COBRA?

A: The Union has compiled a guide about the many alternative healthcare options that will be available to you should you lose healthcare coverage in the upcoming months. We encourage you to review this guide to explore which plan will be best for you and your family. Click here to be redirected to that guide. If you have any questions, or need assistance, you can contact us at (212) 245-8100 and select option #1.

Contacting a doctor

1 Q: How can I schedule a non-emergency doctor appointment during the crisis?

A: For any HTC-represented workers, covered by the Industry-Wide Benefit plan—and your dependents— you can now schedule a telephone visit for any internal medicine, family practice, and pediatric providers. If you would like to schedule a telephone visit with your provider, please call one of our Health Centers.

- Midtown Health Center: (212) 586-1550

- Queens Health Center: (718) 361-5100

For any HTC-represented workers covered by UNITE HERE HEALTH Plan 100 or Plan 105, if your doctor offers phone or video visits, they are covered and if your doctor is in network, they’re covered at 100%. If you cannot get an appointment with your doctor, you can now access a healthcare provider through Teladoc. For more information, visit UNITE-HERE Health’s website: https://www.uhh.org/coronavirus.

2 Q: Is there a number I can call for more information on the coronavirus?

A: Yes. Our Industry-Wide Benefit Funds have set up special phone numbers, staffed Monday thru Friday 9:00 AM – 5:00 PM at the Health Centers to answer questions about the coronavirus outbreak. These hotlines are available to all HTC-represented workers regardless of whether or not they are covered by the Industry-Wide Health Care Plan.

Hotlines:

- Midtown Health Center: (212) 586-1550 (ask to speak with a nurse)

- Queens Health Center: (718) 361-5100 (x3888)

Weekend and After Hours:

- HTC-represented workers who are part of the Industry-Wide Health Care Plan can call the Empire Nurse hotline at 1-877-825-5276.

- HTC-represented workers who are covered by the UNITE HERE HEALTH Plan 100 and Plan 105 can call 888-364-3065 .

3 Q: Am I able to speak to a therapist or counselor during this crisis?

A: For all HTC-represented workers covered by the Industry-Wide Benefit plan—and their dependents – the Members Health Assistance Program (MHAP) is offering counseling services over the phone for existing patients as well as setting up new patients over the phone. All counseling sessions are totally confidential. To be connected with a counselor, please call MHAP Monday through Friday from 9:00 AM-5:00 PM at (212) 237-3037 or (888) 615-6427.

For any HTC-represented workers covered by UNITE HERE HEALTH Plan 100 or Plan 105, you can receive counseling services from counselors and therapists within BlueCross BlueShield’s network.

4 Q: I am a member on UHH Plan 100 or Plan 105, can I get tested for the coronavirus?

A: For any HTC-represented workers and their families who are covered under UNITE HERE HEALTH Plan 100, Plan 105, or Plan 400, any medically necessary COVID-19 testing is covered at no cost to you. This means you won’t have to pay out of pocket for any testing that your doctor orders related to the coronavirus. Plus, if your doctor is in-network and offers phone or video appointments, they are covered at 100%. For more information, you can contact UNITE HERE HEALTH at: 866-261-5676.

Non-Union Workers

Non-Union Workers

For individuals in need of healthcare coverage:

1 Q: What happens when I no longer have healthcare coverage?

A: If you lost your health insurance due to the coronavirus pandemic, there are a number of options available to you. Under the American Rescue Plan, which was passed on March 10, 2021, the federal government is providing a 100% subsidy for COBRA for many laid off workers from April 1, 2021 to September 30, 2021. This will allow many laid off workers to return to their employer’s healthcare plan. If you are not eligible for subsidized COBRA under the new law, you can also apply for a publicly subsidized healthcare plan, or purchase a Qualified Health plan through the Affordable Care Act’s Health Insurance Marketplace.

2 Q: How do I enroll in subsidized COBRA?

A: Under the American Rescue Plan, the federal government plans to pay 100% of the cost of COBRA for many laid off workers for the next six months, from April 1, 2021 through September 30, 2021. The enrollment details have not yet been released. You should reach out to your Human Resources Department or Health Care provider for more information.

3 Q: How do I enroll in affordable healthcare in New York State?

A: New York State has several programs that can provide you and your family with affordable healthcare if you do not have health insurance. These programs include:

- Medicaid

- The Essential Plan

- Child Health Plus, if you have dependent children.

- Qualified Health plans (“Obamacare” Marketplace plans)

Eligibility for Medicaid, the Essential Plan, and Child Health Plus depends on several factors including your income, family size, and whether you have dependent children. There are no income criteria for Qualified Health plans, but you may be eligible for subsidies to lower your plan’s cost, depending on your income. An easy way to apply for all of these programs is to send in an application to the NY State of Health marketplace. You do not need to send in an application for each program — the NY State of Health will decide which program(s) you and your family are eligible for based on your application. You can read more about your options for affordable healthcare in New York State, including how to apply for programs, here.

4 Q: How do I enroll in affordable healthcare in New Jersey?

A: New Jersey has programs that can provide you and your family with affordable healthcare if you do not have health insurance. These programs include:

- NJ FamilyCare (Medicaid, CHIP and Expanded Medicaid populations)

- Qualified Health plans (“Obamacare” Marketplace plans)

Eligibility for NJFamilyCare depends on several factors including your income, family size, and whether you have dependent children. There are no income criteria for Qualified Health plans, but you may be eligible for subsidies to lower your plan’s cost, depending on your income. You can read more about NJFamilyCare and Qualified Health plans here.

For general healthcare information, visit Get Covered New Jersey.

Related News

What happens when the emergency funding of the Benefit Funds ends in January?

October 3, 2020 1:45 PM

As previously reported, unless the city’s hotel industry recovers by the end of the year and a large number of members are recalled, it is very likely that the Benefit Funds will have to temporarily reduce staffing and close locations in January, reducing services for those workers who remain working – at least until the industry recovers. Read more...

Find alternative healthcare

Updated December 23, 2020 3:24 PM

During this catastrophe, the federal government utterly failed the people they are supposed to serve and the toll has been more horrific even than most American wars.

Our Union, however, has moved mountains to win extraordinary protections and special benefits to assist the workers we represent to get through this emergency. The most important example has been the Union’s success in persuading and compelling a devastated industry to continue to fund healthcare coverage for most of the 40,000 workers we represent (most of whom are laid off) over a period of many additional months.

We have compiled this guide about the many alternative healthcare options that will be available to you should you lose coverage in the upcoming months. Read more...

Can I receive payment for my paid time off to extend my healthcare?

September 25, 2020, 2:46 PM

Before this pandemic, under the long-standing rules of the Industry-Wide Benefit Plan, covered employees were eligible for healthcare if they worked enough hours (functions in the case of banquet servers) or as part of a severance package. Laid off workers were generally not eligible and payment of accrued time off typically did not extend their eligibility for healthcare.

However, to meet this emergency, on August 25th, HTC President Rich Maroko convened a special meeting of the trustees of the Funds and convinced the trustees to amend the plan so that payment of paid time off would extend healthcare coverage. The trustees also approved a temporary plan that allows the workers we represent to maintain partial healthcare coverage. Read more...

Union wins three more months of healthcare and structured severance pay for workers from IWA and Division A shops in landmark arbitration

Friday, September 11, 2020 7:31 PM

The arbitrator’s decision requires IWA and Division A employers to pay for an additional three-month extension of healthcare coverage for employees who are still on layoff as a result of the pandemic. Those workers are now guaranteed healthcare through the end of 2020. Most employees from those same IWA and Division A shops (who would be entitled to severance pay in the event the shop permanently closed) will soon be entitled to extra pay each week to supplement their unemployment benefits as a structured payout of severance. Read more…

NYC offers free COVID-19 testing and antibody tests

July 2, 2020 6:25 PM

On June 29, NYC Health + Hospitals began to offer free antibody tests at locations across the five boroughs. The City is also offering free COVID-19 testing to all New York City Residents, whether or not they have had symptoms of the virus. Both tests are available regardless of immigration status or insurance coverage. To read more, click here.